Applying for a loan in Nigeria is not as complicated, GT Bank is open for all who are willing to loan but the question is are you qualified? In this article, we discuss all the steps involved in getting a successful loan. After reading this post, we are going to qualify you for GT Bank loan.

Here are the main topics we are going elaborate more on GT Bank loan, GT Bank loan pin, GT Bank interest rate,

GT Bank loan balance code, how to get loan from GT Bank, GT Bank soft loan, and how to qualify for GT loan.

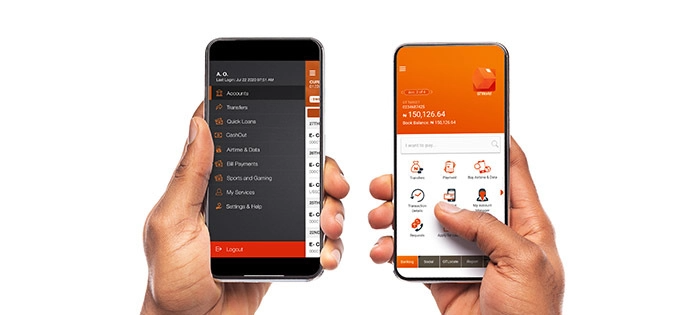

HOW TO DOWNLOAD GT BANK APP

QuickCredit is also available on all GTBank online and mobile banking platforms (Internet Banking, GTWorld and GTBank Mobile App).

To download GT on your mobile phone, on your Google Play store or app store; Using BANKING METHOD

How To Open An GT Bank Account

- On your mobile phone and click on Google Playstore/App Store and Install the GT Bank App.

- Then, click “Open“.

- Log in.

- Enter your full “Name and Password“.

- Provide necessary information needed for security purposes.

- Submit.

As a new user, complete the loan form by entering your full name, phone number, and home address.

- Then, enter the loan amount you want to borrow.

- Cross-check your information to know if it is correct and click on “Submit“.

- Accept their “terms and conditions” before submitting.

- You will be notified of the loan’s approval or rejection within a few minutes or hours.

- Once, it is approved your desired amount will be sent to your account number.

Using BANKING WEBSITE METHOD:

You can visit www.gtbank.com and click on the “REGISTER” button on the Internet banking tab and tap open an account. At the GT Bank account opening form, provide all the necessary information needed. You can choose YES or NO for the BVN option or dial *737*6*5# from your registered phone number with the bank.

When you are done with registration, you can now perform all these activities such as check your account balance, loan, electricity bill payments, buy data, buy airtime for others, buy airtime for yourself, transfer money to an account, ATM card activation, and also transfer money to other bank accounts.

Also, see: Quick Loan- Unity Bank Loan USSD CODE In Nigeria

Here Are The Terms And Conditions For Applying For GT Bank Loan

Here are the requirement needed, before you can apply for a loan from GT Bank.

- Enter your country, if you are a citizen of (Nigeria) or any other country.

- You must have an active account on GT Bank.

- You must enter your (BVN) bank verification number and also provide your National ID card, and driver’s license.

- You must have a certain amount on your account.

How To Qualify For GT Loan

For you to be qualified for a GT loan, you must meet up with the following:

- You must have a minimum monthly lodgement of N20,000

- You must earn a minimum net monthly salary of N10,000.

- You must not have any printed form (cheque) that has no value

- You must have satisfactory credit reports.

- You must not have any unpaid obligations.

How to Borrow Money From GT Bank

These are steps to follow to get a loan from GT Bank: Turn on your internet, such as a PC or smartphone and visit your Google Play Store to download the GT Bank App.

- “Log in” to your GT Bank account.

- Scroll down to the bottom of the homepage and click on the “finance” tab.

- Choose the “Loan” option.

As a new user, complete the loan form by entering your full (FIRST, MIDDLE AND LAST) name, phone number, and home address.

- Then, enter the loan amount you want to borrow.

- Cross-check your information to know if it is correct and click on “Submit“.

- Accept their “Terms and Conditions” before submitting.

- You will be notified of the loan’s approval or rejection within a few minutes or hours.

- Once, it is approved your desired amount will be sent to your account number.

How To Loan Using GT Bank USSD Code

Here are the steps to follow, when you want to use the GT Bank USSD code to loan. But have this in mind before you can follow these steps, you must have an active account with GT Bak and also use a mobile phone that has the registered number SIM.

Note: Using these steps, you don’t not a network connection on your PC or smartphone.

- On your phone (keypad dialler), dial *737# and send the code.

- On the displayed menu, choose “Loan“.

- Enter your (Account number).

- Enter the amount you want and sent it.

Provide the necessary information that is needed to apply for a loan and submit it. Once, it is approved, a notification will be sent to your phone that your account has been credited.

In a tabular form, we are going to state the activities you can perform while using the GT BANK USSD CODE.

| FUNCTION | USSD CODE |

| Buy Airtime | *737*amount# |

| Buy Airtime For Other Line | *737*4# |

| Create Transaction Pin | *737*5# |

| Check Account Balance | *737*6*1# |

| Loan Balance | *737*6*2# |

| Startime Tv Recharge | *737*37*Amount*Decoder Number# |

| Cardless Withdrawal | *737*3*Amount# |

| Cable Tv | *737*SmartCardNo# |

| Payday Loan | *737*52*40# |

| Enable/Disable Account Balance on GeNS | *737*51*1# |

| ATM Card Status | *737*6*3# |

| Account Blacklist | *737*51*74# |

| Spend To Save | *737*51*24# |

| Generate OTP | *737*7# |

| Money Transfer To GT Bank | *737*1*Amount*NUBAN Account Number# |

| Transfer Money To Other Banks | *737*2*Amount*NUBAN Account Number# |

GT BANK USSD CODE FOR ELECTRICITY

| ELECTRICITY | USSD CODE |

| Port Harcourt Prepaid | *737*50*Amount*95# |

| Eko Prepaid | *737*50*Amount*151# |

| Ibadan Prepaid | *737*50*Amount*137# |

| Kano Prepaid | *737*50*Amount*93# |

How Much Can I Borrow From GT Bank For The First Time

Excellent question as a first-time user you don’t expect to borrow up to the amount other users can borrow. GT Bank loan offers a minimum loan amount of N10,000, a maximum of N500,000 for non-salary holders, and 5 million for salary holders.

How To Repay GT Bank Loan

Let’s move to how you can repay GT Bank loan; after your loan has been approved you will be given a due date to repay the money you have borrowed. These are steps to follow in order to repay the money that is borrowed.

- On your phone (keypad dialler), dial *737*0# on your phone.

- Choose option “4” (Repayment)

- Choose option “2” (Close Credit)

- Enter your 4-digit PIN to confirm the transfer.

GT Bank Customer Care

If you in any way have difficulties in how to loan using GT Bank online banking app or GT Bank USSD code, you can contact the GT Bank customer agent for assistance.

(GTConnect) on 01448000, 0700482 666328, 08029002900, 08039003900, 737 or Visit any GTBank branch around you.

Do you find Six9ja useful? Click here to give us five stars rating!